Chances are, you already have a destination in mind for your next vacation. Statistically, chances are even greater that you have not created a budget for the trip. Most American travelers will only create an estimated amount for the total trip cost after they decide on the destination, but very few create a realistic budget … even fewer stick to it! According to the Detroit Free Press, 68% of Americans overspend on their vacations! Why? Because they fail to create a realistic budget and plan ahead for travel expenses. As your travel advisor, I want to help set you up for success!

Before We Start: Some Things to Consider

Some questions to consider when creating your travel budget: What goes into deciding how much to spend? How do you decide how much to spend in each area? Most importantly, how can an effective budget keep you from blowing your budget? Continue reading to learn about our recommendations and how-tos for successfully budgeting for travel.

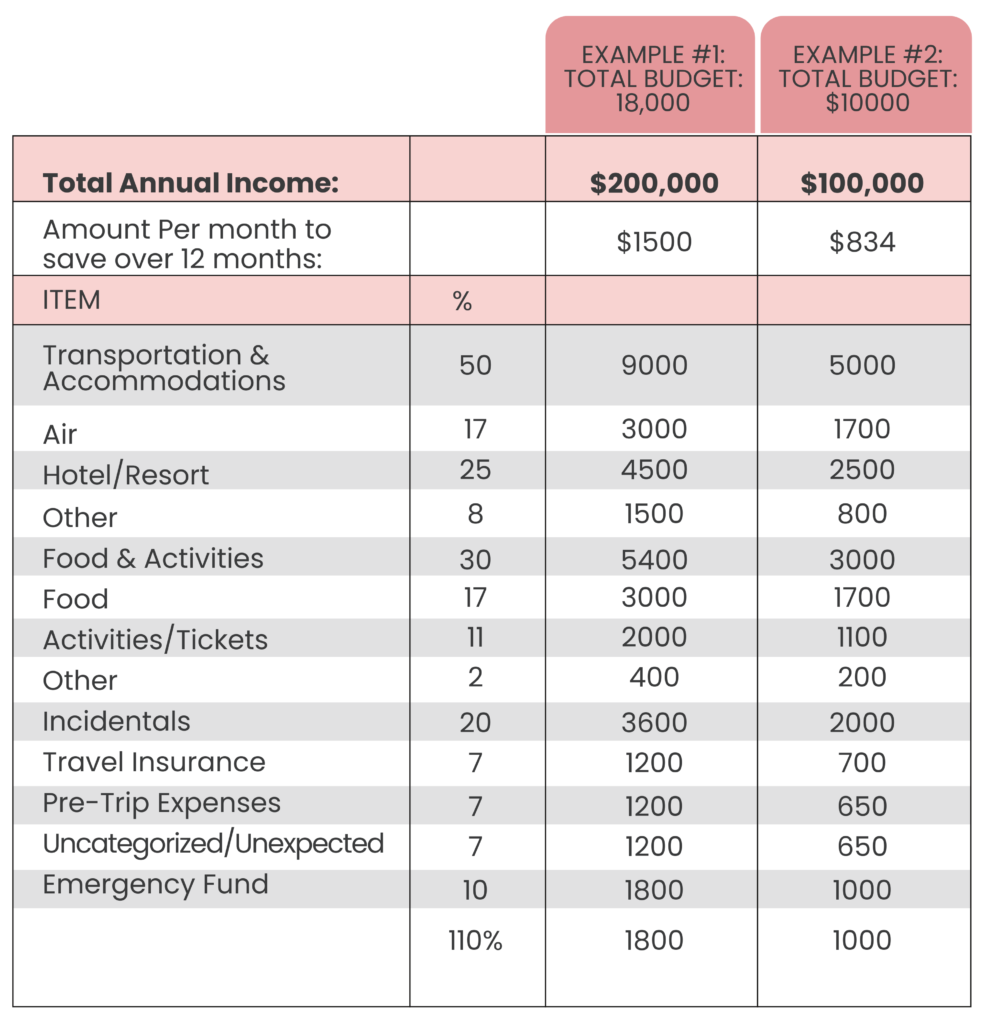

Before you go any further, it’s important to know how to set your overall budget, no matter the destination. A great rule of thumb is to budget 10% of your annual income to travel. Most Americans spend anywhere from 5-15% annually on travel. Whether you use an annual bonus or set aside money from each paycheck, this is a great way to determine your total trip budget. If you travel more than once a year, you will need to divide this total accordingly.

Next, consider the destination. We know that you are already daydreaming about your next trip. That’s great! You will need to know a bit about your destination so you can properly budget for it. What do you know about this destination? Have you been there before? If not, your trusted travel advisor can help you determine a realistic budget for this destination with you.

The Makings of a Successful Budget

Now you’ve got the destination and your total budget. Now let’s get into the nitty gritty: how do you allocate expenses accordingly? We like to follow a basic budgeting rule called the 50/30/20 rule, but with a few modifications specific to travel, so you do not become another “I overspent on vacation” statistic. We encourage you to “guess high” on your numbers to stave off any surprises later. It looks like this:

- 50%- Transportation and Accommodations

- 30%- Food and Activities

- 20%- Incidentals

- 10%- Emergency fund

Yes, we know that equals more than 100%! Let’s break down each category to find out why.

50%: Transportation and Accommadations

Half of your budget should be for travel and accommodations. This includes airfare, resorts/hotels, car rentals, gas for said car rental, and parking. This is a great place to start when creating your budget and is usually the easiest to forecast. Due to the current climate of air travel, you may want to consider overestimating this item!

30%: Food and Activities

Food equals all meals, including dining out, groceries, tips, drinks, and snacks. Activities mean excursions, activities, tickets, and passes. This category is where most budgets go wrong because travelers typically do not allocate enough. Not all destinations are created equal — dining and groceries can vary greatly by destination, so do your research. Activities tend to be a little easier to predict but make sure you allow for any in-the-moment/in-destination items that may pique your interest.

20%: Incidentals

Several small things fall under incidentals: tips and gratuities, resort fees, baggage fees, pre-trip expenses, souvenirs, and other one-off items that you may not always be able to forecast. It is important to budget for the unexpected! This category often gets travelers into trouble because they fail to plan for the unexpected. By planning ahead and adding it to your budget ahead of time, you’ll save yourself the stress during travel. This item should also be used for pre-trip expenses like updating passports, buying new luggage, parking at the airport, travel insurance, or even paying a pet sitter. This is a great place to have a line item for having cash on hand. Our recommendation is to have $50-100 per day to use for tipping or small purchases.

10%: Emergency Fund

This item is where you go beyond the 100%: it is wise to save extra money in an emergency! No one wants something terrible to happen when you’re traveling. (ALWAYS get travel insurance! You’ll notice it’s built into the budget above). While travel insurance can cover major expenses, what about things not covered? From here, the worst-case scenario is that you must tap into this item for something unexpected during your trip, like dropping your phone in the ocean when you’re parasailing or accidentally leaving your carry-on at your layover. Best case: you budgeted so well on the rest of your trip that this becomes your starter fund for your next vacation! We recommend keeping this in a safe account that you can easily access in an emergency.

Here’s our example of a proper vacation budget, according to our tips above:

By now, we hope you have a clearer picture of creating a successful budget for your next trip. If you have questions or are unsure how to apply this technique to your next trip, we’re here to help! Your vacation consultation is a great time to have this discussion. We’d love to assist you!